Tax levy nearly $2.5 million

By Bert Lehman

The city of Clintonville’s property tax rate will increase to $11.12 per $1,000 of equalized value, which is up 53 cents from last year.

The Clintonville City Council approved its 2022 budget at a special council meeting Nov. 16.

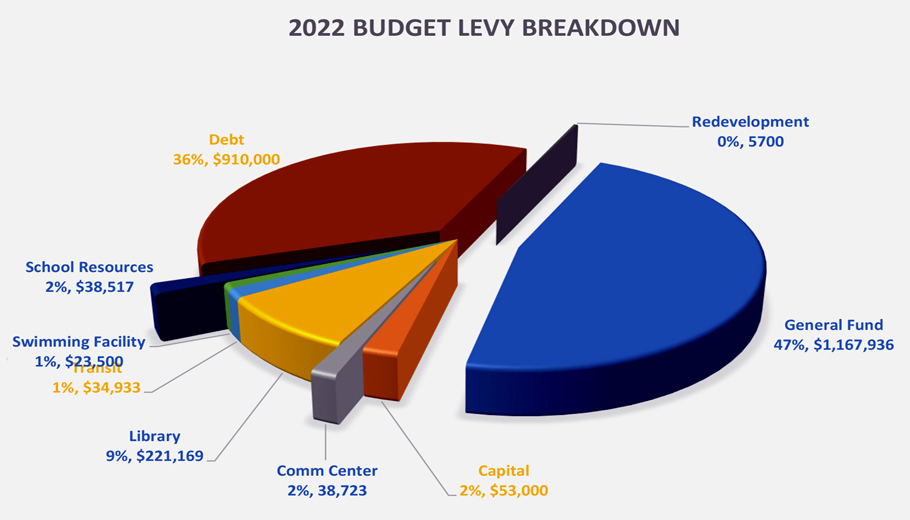

The budget that was passed includes a tax levy totaling almost $2.5 million.

The city’s tax rate first went above $10 in 2019 when it was $10.08. The 2022 budget is the first time the city’s portion of the property tax rate will be above $11.

“There has been significant growth in the mill rate in the last 10 years and efforts should be made to lower taxes through additional non-TID developments and considerations on the level of services should also be made if growth does not happen at sufficient rate,” Eveland said in a 2022 Proposed Summary and Analysis of the budget.

2022 budget highlights

The budget includes a 3% COLA (cost of living adjustment) for all non-union city employees. The COLA will be applied to the salary schedule, and not to individual wages.

Members of the Clintonville Professional Police Association will receive a 2% raise, as negotiated in their union contract.

Health insurance premiums increased by 5%, but the budget does not include changes to the insurance premium share percentages.

At the Nov. 15 budget hearing during the Clintonville Finance Committee meeting, Eveland said the initial percentage increase in the city’s health insurance premium was higher, but was able to be negotiated down to 5%.

The passed budget includes no changes to the number of full-time employees the city has. It does include minor adjustments for part-time hours.

The 2022 budget includes a “significant” drop in the contingency fund, Eveland said at the budget hearing.

“One of the things we had been doing with our contingency was increasing that, so when we have the step increase years, there is room to adjust,” Eveland said. “We don’t have that kind of cushion now.”

She said the drop in the contingency fund is a concern.

The city’s undesignated fund balance at the end of 2020 was $1.48 million, or 37.1% of the city’s 2021 operating budget. After making some transfers approved by the council, the undesignated fund balance at the end of 2021 is projected to be 36.6% of the 2022 operating budget. The city’s financial management policy has a target minimum of 25% of the subsequent year’s general fund expenditures.

“The Council should give consideration to designating $100,000 of the GF FB (general fund fund balance) for the reevaluation and to transferring up to $250,000 to the Swimming Pond Facility to reduce what is needed to be borrowed for that project in 2022,” Eveland said in the budget analysis.

Debt service, fund balance

The 2022 budget calls for debt service payments of just over $1 million. The tax levy will cover $910,000, with the balance being primarily funded by the debt service reserve.

“In order to limit the impact to taxpayers, the City will need to continue to transfer operational savings to the debt service fund balance to offset the increase to the required debt payment for 2022-23,” Eveland said in the analysis. “The City will need to borrow for the Swimming Pond project in 2022 with that process to begin no later than late Spring/early Summer 2022 (depending on when construction is expected to start).”

The passed budget also meets the expenditure restraint program (ERP) and maximum levy limits imposed by the state of Wisconsin. This qualifies the city for approximately $79,000 in additional state shared revenue. The ERP limit is 3.1%, and the 2022 budget puts the city at just over 1.5%.

“In addition, the City is utilizing the post-2005 debt exception for levy limit restrictions, allowing it to levy additional funds beyond that allowed by net new construction,” Eveland said in the analysis. “Utilizing these exceptions will continue to be feasible while the City’s debt payments remain high but efforts to find new revenue sources is imperative.”

Summing up the budget, Eveland said, “There has been some new development and growth but the assessment ratio has continued to plummet. A full revaluation is needed to bring the assessed value back in line with the market and to ensure property owners are all paying their fair share of the property tax. While this is an expensive undertaking, it is the best way to go to ensure accuracy, and the Council needs to begin planning for how it will fund and structure that project.”