Jenson focuses on state aid, fund balance

By Robert Cloud

City Administrator Aaron Jenson reviewed city finances during the Waupaca Common Council’s July 18 meeting.

Jenson noted that the city currently has $1,97 million general fund balance, representing 24.7% if its total budget.

Policy requires the city’s fund balance to be between 20% to 25% of the total budget.

Between December 2021 and December 2022, the general fund balance decreased by about $189,000.

Jenson attributed $138,662 of that decrease to retirement payouts during the last two weeks in December.

When city staff retire, the city compensates them for accumulated vacation and sick pay.

“What we do to recoup those costs is that we have vacancies in those positions,” Jenson said.

The city normally waits a few months before filling the position aith a full-time employee.

Among those retiring last year were Police Capt. John Helgeson, City Clerk Sandy Stiebs and Library Director Peg Burington.

Other factors contributing to the decline in fund balance were a drop in building inspect on fees, police fines and forfeitures and water utility tax equivalents.

“Those revenues were down in 2022, but are on track to meet 2023 projections,” Jenson said.

The city’s debt service fund balance increased by $969,000 to $1.56 million this past year.

Jenson said the debt service fund “can only be used for one thing and that is to pay off our debt. It can’t be used for anything else.”

He attributed some of the increase in the debt service fund balance to some of the city’s tax incremental financing districts closing and paying back money to the debt service fund.

Act 12 and shared revenue

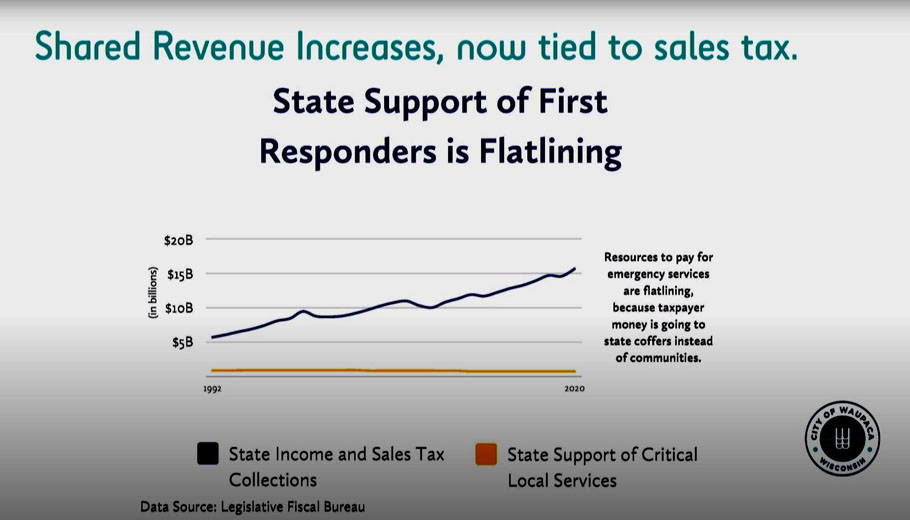

Jenson said the state recently passed Act 12, which will increase county and municipal aid payments by 20%.

In 2022, the city of Waupaca received $871,182 in state aid payments.

Waupaca will receive an additional $174,256 for a total aid payment of $1.04 million in 2024.

Jenson said the city will continue to receive a base amount of about $870,000 in state aid, which will be supplemented by an amount based on state tax revenues.

If total state tax revenues increase, then so will state aid to municipalities.

But declining sales tax revenues mean lower state aid for municipalities.

During economic downturns, sales tax revenues often drop.

Act 12 also stipulates that for municipalities to qualify for the supplemental state aid payments, they must, at a minimum, maintain current funding for essential seervices. these include police, fire, emergency medical services, public works, courts and transportation.

If a municipality cuts any of these services after receiving the supplemental aid payments, they will be penalized, Jenson said.

Jenson noted that public libraries were not included among essential services recognized by Act 12.

State aid accounts for 3.5% of the city’s budget, Jenson said. Local property taxes pay for the majority of Waupaca’s revenues.