18% levy hike projected

By Robert Cloud

The New London School Board approved an 18% increase in the district’s 2023-24 tax levy at its Sept. 11 meeting.

The district’s 2023-24 general operations (Fund 10) levy will be $8.91 million, up from the nearly $7.2 million Fund 10 levy for 2022-23.

This year’s tax rate will rise by 5% over last year, up from $5.55 to $5.82 per $1,000 of property value.

Total property values in the New London School District increased by 13% this past year.

How the increase will impact local property owners will depend on their municipality and how much their property values are rising.

“If the property valuation goes up, the mill rate goes down,” said Joe Marquardt, the district’s business services director.

Marquardt attributed the district’s tax increase to changes in state revenue limits or spending authority on schools.

“New London has been in the bottom 125 school districts in spending authority per pupil, but with this additional authority, New London will be at the same level as 70% of the other school districts,” he said.

Wisconsin has 421 school districts.

New London’s revenue cap is set at $11,334 per pupil for 2023. The district’s total revenue cap was $24.95 million for 2022-23. It is estimated at $26.48 million for 2023-24.

According to the Wisconsin Department of Public Instruction, state general aid to New London will increase by $67,883 to $17.14 million in 2023-24. However, New London will not know the final amount until Oct. 15, Marquardt said.

In explaining the sharp increase in the 2023-24 tax levy, Marquardt said, “The district will have $1.5 million in (additional) levy authority, but will not receive equalization on that spending until next year.”

Statewide, equalization aids increased by 3% in 2023-24 and will increase another 4% in 2024-25.

“More equalization aid reduces the local property tax levy,” Marquardt said.

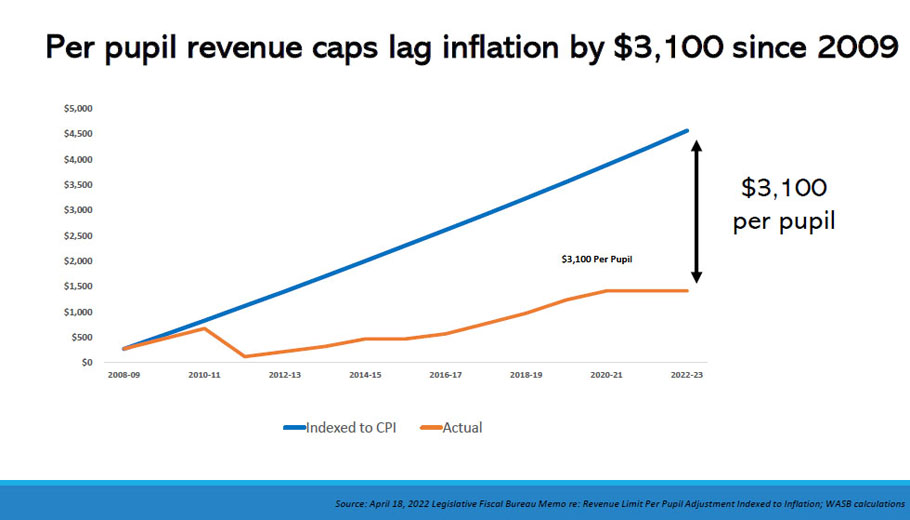

Marquardt noted that school districts’ revenue caps have failed to keep pace with inflation.

If the revenue caps had kept pace with inflation, the New London School District would now be receiving $3,100 more per pupil annually.

Budget numbers

The total 2023-24 school budget is set for $36.25 million, which is 3% lower than the 2022-23 budget at $37.47 million, which includes all revenues and expenditures.

In addition to Fund 10, the district will levy $349,180 for Fund 38 and $100,000 for Fund 80.

Fund 38 is for nonreferendum debt within the district’s revenue limits. This levy is dropping by more than $678,000 due to the district paying off debt on the Parkview and Readfield school projects.

Fund 80 is designated for activities that serve the community, such as after-school programs and police liaison officers.

Concern for taxpayers

Board member Katie Batten said she was having a hard time explaining the sharp increase in the tax levy to her constituents.

“I ran on being fiscally responsible,” she said, noting that her own family, as with many others in New London, is trying to cope financially due to wages not keeping up with inflation.

“Business Insider said American savings will be depleted by the end of Q3,” Batten said. “People don’t have a lot of extra money.”

“The funding process is unfair sometimes to the school board because you are working through the mechanics of a formula that is hard for you to control,” Marquardt said.

State lawmakers pulled much of the authority of school district’s budgets away from local school boards while failing to provide sufficient funding, he said.

“Instead of the levy jumping up and down because of state funding decisions, it would be easier on taxpayers if it was steady,” Marquardt said.

When the school board approved the $8.91 million Fund 10 levy, Batten cast the sole vote against it.