Hayek warns of possible future deficits

By Robert Cloud

Both the tax levy and the tax rate for the Waupaca School District’s 2023-24 budget will go down.

The property tax levy is projected to drop from $11.39 million in 2022-23 to just under $11.32 million in 2023-24.

The district’s tax rate will decrease from $5.64 to $4.79 per $1,000 of property value, according to Carl Hayek, director of business services.

Hayek presented a preview of the 2023-24 budget at an Oct. 10 Waupaca School Board meeting.

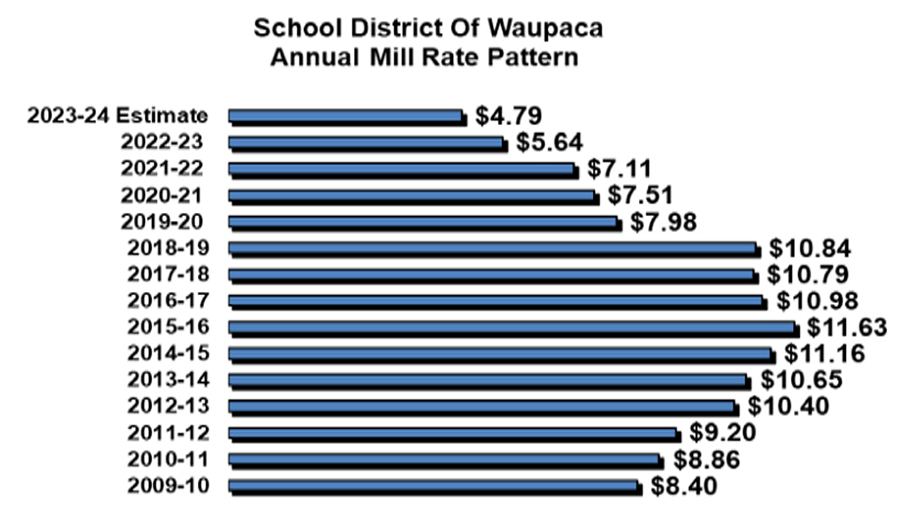

“We’ve had a tax decrease for the last 3-4 years in a row,” Hayek said.

At its high point in 2015-16, the district’s mill rate was $11.63.

In 2019-20, Waupaca’s property tax rate dropped to $7.98 per $1,000 of equalized value and have steadily declined every year since.

On a $100,000 home, the 2023-24 mill rate equates to $479 for the district’s portion of the owner’s next property tax bill, down $85 from the previous year.

Hayek noted that property values are rising, so the individual tax bills may not decrease by the same amount.

Total property evaluation in the Waupaca School District is projected to rise from $2.02 billion in 2022-23 to $2.36 billion in 2023-24.

Property taxes account for 39.2% of the district’s $28.66 million total Fund 10 budget, which covers general operating costs.

State revenues provide 51.82% and federal sources account for 5.3% of the Fund 10 budget. Other sources cover the remaining 3.67%.

In addition to the general budget, the district has separate budgets for special projects at $4.75 million, debt service at $561,250, capital projects at $4.19 million, food service at nearly $1.22 million.

Expenditures

Hayek described two different perspectives on the district’s spending.

Expenditures by function categorize Fund 10’s $28.66 million budget at 50% for support services, 46% for instruction and 4% as non-program transactions. Support staff includes administration, athletics, aides, custodians and everything that is not instruction.

Expenditures by object categorizes the general budget as 75% for salaries and benefits and 25% for non-salary items, including maintenance, utilities and transportation.

To balance the 2023-24 budget, Hayek said the district needed to find savings and cut costs in some areas, even as some areas saw major cost increases.

Spending increases included $540,000 more for teacher salaries, $211,000 more for support staff (including administration) salaries and $230,000 more for health insurance.

The district also saw its revenue cap drop by $155.000, for a total budget impact of $982,000.

Budget reductions included $130,000 in savings in property insurance, $30,000 in savings for the Rural Virtual Academy, $53,000 for vehicle maintenance, $100,000 for building maintenance, $40500 for middle school substitutes and $465,000 savings in new teacher replacements.

Hayek said new teachers are paid lower salaries than retiring teachers who had many more years of experience. Some positions were not filed after teachers retired or left the district.

The district will also save nearly $84,000 on an unfilled vacant position, more than $41,000 on contracted maintenance service and $25.000 after receiving a COPS school safety grant.

Budget increases and decreases both equalled $982,000.

Deficit spending, fund balance

In 2023-24, the Waupaca School district will have a balanced budget with revenues and expenditures each at $28.66 million.

However, Hayek projected future budget deficits.

The district’s budget deficit will rise from $896.000 in 2024-25 to $9.3 million in 2029-30.

Among the factors contributing to the projected deficit are unreliable state aids and the federal Elementary and Secondary School Emergency Relief Fund expiring.

“ESSER 3 funded salary positions of $360,000 will be done,” Hayek said. “The 2024-25 budget cannot support these positions any longer or the equivalent of other positions in this amount will have to be reduced or the 2024-25 budget will not balance.

Hayek said salary increases based on percentage raises compound each year.

Inflationary pressures on utilities, insurance and contracted services are also contributing to growing expenditures.

The deficit will have a negative impact on the district’s fund balance, according to Hayek.

Because school expenditures are fairly consistent throughout the year, while revenues from the state aid and local taxes arrive sporadically, Wisconsin school districts tend to face cash flow pressures in October, November and May.

A healthy fund balance means the school district does not need to rely on short-term borrowing to pay its bills.

Currently, Waupaca’s fund balance is at $11.24 million.

However, as the district seeks to cover its future deficits by drawing from its savings, Hayek projected the fund balance to drop below zero by 2028-29.

“Anything new, any added percentage increase for any annual item, increases the budget by that amount forever unless an ongoing annual budget reduction is made in the same amount,” Hayek said.